The Russia-Ukraine crisis brings along several risks for a world economy that has yet to fully recover from the economic effects brought by the pandemic. While our hearts and minds are with the people who are in the middle of the war, the founders of BricksFolios provide some insights on how this crisis could impact the Real Estate market in the Seattle region and the United States.

Russia-Ukraine War: Impact on Mortgage Rates

As the stock markets plummet, stock investors seek some semblance of “certainty”. Because nobody really knows the outcome of any kind of war, investors want the surest bet. Most stock investors would move their money to bonds to avoid losing money. When investors demand more bonds (i.e., mortgage-backed securities), the price of these bonds would typically go up, while interest rates (i.e., yields) would fall.

After a steady increase of mortgage rates since January this year, homebuyers are now seeing some relief as markets react to the Russian invasion of Ukraine. As of Thursday, 3rd March 2022, the average rate for the 30-year fixed-rate mortgage was 3.76%, down 13 basis points from the previous week, according to Freddie Mac FMCC. One basis point is equal to one-hundredth of a percentage point. Just a few weeks ago, the average 30-year loan rate jumped to almost 4%, the highest level since May 2019.

Unfortunately, the dip in mortgage rates may not last long. With inflation hitting its highest in 40 years, the Russia-Ukraine crisis may only provide some temporary relief for homebuyers. During the Financial Services Committee hearing on 2nd March 2022, the Federal Reserve Chair Pro Tempore Jerome Powell said he would “support a 25 basis point rate hike.”

Do note that mortgage rates are not directly correlated with the Fed Rate but they tend to track the yield on the 10-year Treasury note.

If you are in the market to buy your investment properties or your dream home, you may want to lock the interest rate.

If you are in the market to buy your investment properties or your dream home, you may want to lock the interest rate.

Jo Dixit, Chief Wealth Officer, BricksFolios.com

Russia-Ukraine War: Impact on House Prices

Head of petroleum analysis for Gas Buddy, Patrick de Haan, believes that what happens in Russia could have a profound impact on our country in terms of energy availability and price.

This being said, a likely increase in gas prices will play out in the coming few days.

When this happens, the cost of transportation will increase as well. This increase would cascade throughout the entire supply chain. This means that the price of everything else would likely go up.

In real estate, this will push the prices of raw materials further thereby increasing the cost of construction.

As you may have noticed, we have already seen skyrocketing home prices since 2020. In Washington alone, in 2021, we saw a 20.4% system-wide increase in single-family homes, not including condominiums.

Will the U.S. Housing Crash in 2022? Click HERE to read more.

With the Russia-Ukraine crisis, new home constructions would significantly be more expensive than ever before. Real estate developers would also hike the prices up to cover the expense and make a profit.

Russia-Ukraine War: Impact on Homebuyers’ Capacity to Make Down Payments

As mentioned earlier, stock investors dislike uncertainties, in the same way, that global markets dislike conflict. This leaves financial markets volatile and weakened.

Homebuyers who rely on their stocks or their 401(k) for a down payment on a new house will be severely affected.

Likewise, volatility in the financial markets may wear down consumer confidence.

Russia-Ukraine War: Impact on Demand for Homes

In the near term, this war could further boost our real estate. Wealthy Russians and Ukrainians have different reasons for moving their money overseas, and investing in more-stable Western markets is nothing new for them. The anecdotal evidence indicates they are trying harder than usual to get their money out of Ukraine and Russia as quickly as possible and into the United States. And overwhelmingly, that money is flowing into American real estate in markets like Seattle, WA, and California.

If this war spills out of Ukraine and leads to NATO getting involved to protect its members, further economic repercussions in the U.S. could begin to manifest (e.g., stifling job growth, limiting pay increases). With the increasing home prices and mortgage rates, demand for new homes in the U.S. may potentially decline. This would lead to more demand for rentals, and thus an increase in rents. Savvy investors would then add more rentals to their portfolio.

What Does the Future Hold for Homebuyers and Real Estate Investors?

What we do know is that inflation expectations remain anchored before the Russia-Ukraine war. However, the Russia-Ukraine conflict will undoubtedly stir the already troubled waters.

Despite homebuyers having more purchase power due to the dipping mortgage rates at the moment, homebuyers and real estate investors might find themselves purchasing more expensive homes later on due to inflation. For others, they may not even be able to afford a new home anymore.

The United States real estate market in general, and booming housing markets like Seattle with a strong local economy, continues to be a safe haven for your money in the midst of a war between Russia and Ukraine.

“The U.S. is an island of growth. [It] is one of the only major economies in the world that has this cushion of $6 trillion in stimulus.”

Joseph Zilde, Chief Investment Strategist, Blackstone

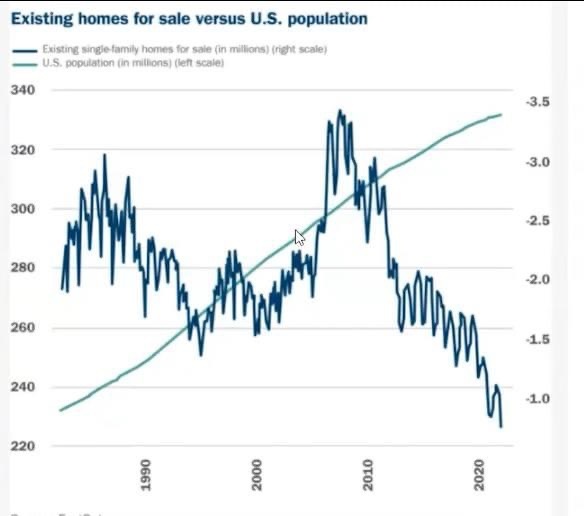

The fact remains. In Seattle and the U.S. real estate, we have too few homes for sale and the demand is very high. The chart below summarizes the severe imbalance between supply and demand.

As for now, we will continue to watch the Russia-Ukraine war and how it impacts Seattle and the U.S. real estate market.

Despite all the uncertainties, you can still build wealth through Seattle and U.S. real estate with the right partners. Don’t just buy a home. Buy a true wealth-building home. BricksFolios powered by InBestments, can help you do that and more!