TL;DR: Positive changes are happening in the economy – inflation is dropping, wages are growing faster than expenses, and long-term loan rates might go down. Even though there’s talk of a mild recession in 2024, now might be a great time to invest in residential real estate as a way to protect against high inflation.

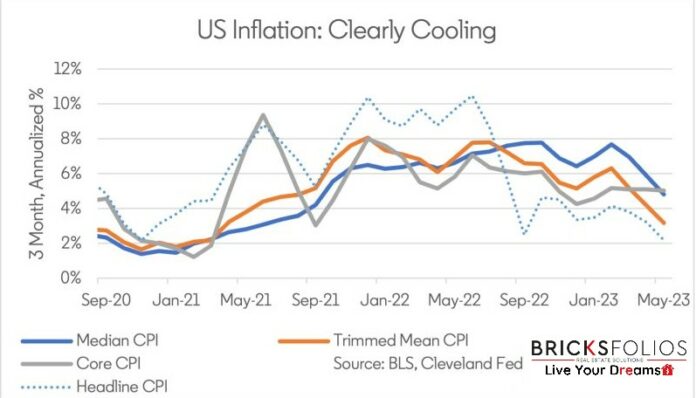

May CPI report is in. The economic landscape is showing some exciting shifts.

The inflation rate, a big concern in recent years, has slowed down to 4% in May. It looks like it might even keep going down in the future.

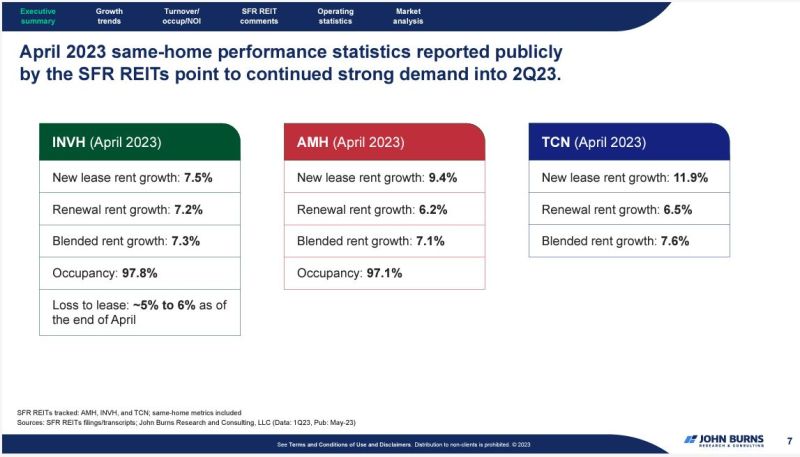

Rents are still growing, but not as fast. Market rent growth has cooled to 4.7% (almost normal?) from its 16.9% high in February 2022.

👋Do remember that the Federal Reserve’s data is a little behind the times, though. All 3 publicly-traded SF REITs just reported 7%+ rent increases.

There’s more good news, too: people’s earnings are growing faster than the cost of living for the first time in two years. This could make life a little easier for many.

The Federal Reserve might stop increasing interest rates because of the lower inflation. The latest inflation data provides room to skip an interest rate increase when the Fed meets on Wednesday, June 14. They could even make borrowing cheaper by the end of this year or early next year.

Update on 6/14/2023: Indeed, as we anticipated, the Federal Reserve held off on increasing interest rates on Wednesday, June 14th. After a series of ten rate hikes, which affected loans for homes and businesses, they’ve decided to pause to review more data. However, they indicated a possibility of two further increases this year to address inflation.

Where are mortgage rates headed?

Another good sign for both the economy and the housing market is the 10-year treasury rate falling to 3.7%. Usually, this means long-term mortgage rates might also go down. We’ve been seeing them around 7%, but they might drop more throughout the year.

However, we need to stay cautious. There’s still the risk of a small recession in 2024, even though a government default was avoided last week and the job market is strong.

This situation creates a unique opportunity. Investing in residential real estate can protect against high inflation besides helping you diversify and take advantage of the tax benefits.

Great time to buy investment properties

Now might be the perfect time to buy investment properties, especially brand-new homes. You could buy these at the list price without waiting for the builder to accept investor offers or getting into bidding wars. You can also get great benefits like free upgrades, closing cost credits, and lower rates through points paid by the seller/builders’ lender. And when the rates do go down in the next year or two, you could refinance and increase your cash flow and the ROI.

You can’t time it better!

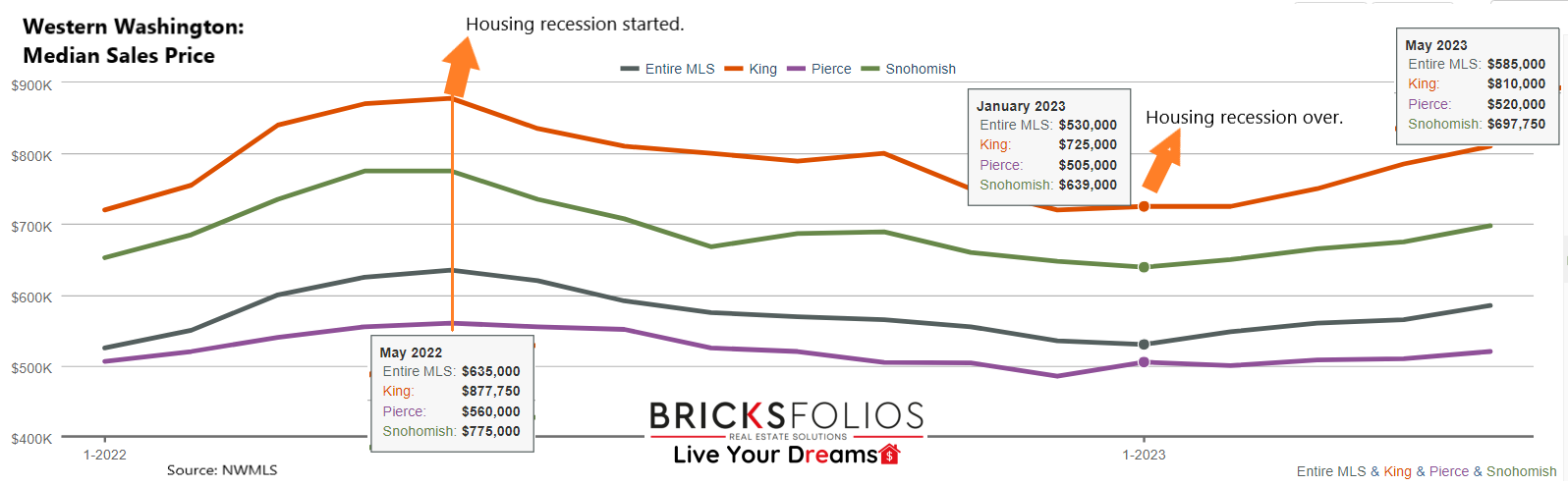

The housing market entered a recession or price deceleration phase in May 2022. This was primarily caused by the rapid rise in interest rates.

However, the housing market seems to have recovered and is on the rebound as evidenced by the month-on-month median price increases since the beginning of 2023.

Consider joining the preferred client list at BricksFolios to get access to curated wealth-building deals.

BricksFolios makes it super easy to build wealth

Let’s create your success story in real estate investing together.

👉https://bricksfolios.inbestments.com/JoDixit/meet-our-founders