You must have seen a ton of inflation news with conflicting views recently.

Probably your stock portfolio also got impacted by the latest inflation report.

Let us help break it down, especially in the context of real estate.

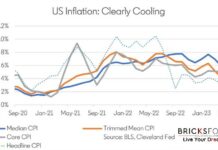

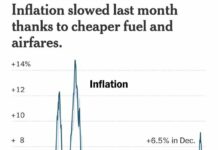

US inflation was 8.3% in August. Still way too high from the typical inflation of 2%.

8.3% is down slightly from 8.5% in July and down from 9.1% in June.

Looks like inflation may have peaked. So that’s the good news.

But, of that 8.3% number, gas prices were down over 10% so other prices, like shelter, food, and medical care, actually went up slightly in August, offsetting the decline in gas prices. That hurts.

This hotter-than-expected inflation led to a broad-based selloff and sent equities to their worst day in more than two years.

Every single stock in the NASDAQ 100 fell yesterday. This is the first time it has happened since March 2020.

There are only 4 other times in history when the S&P 500 fell more than 4% in a given day (3 of those times were during the Lehman crisis).

How has inflation affected real estate?

Mortgage rates have also climbed up.

Most experts think mortgage rates will likely start to come down once inflation has peaked and begins to come down. Rates will likely start coming down in early 2023.

The rapid increase in mortgage rates has priced out a lot of buyers. Additionally, it has made even a lot of qualified buyers nervous.

This has lowered the demand (the Feds want housing to cool).

Where is the opportunity?

This demand reduction has created a lot of opportunities for savvy buyers and investors to grab great cash-flowing/equity-building properties at unheard-of discounts.

Rents rose 0.7% in August, their fastest pace since 1991. This has increased the cash flow for real estate investors.

Real estate is attracting a lot of institutional investors given its inherent hedge against inflation and other advantages.

You may also want to diversify your portfolio with real estate.

Don’t get misguided by news cycles predicting doom. Remember savvy investors build the most wealth during uncertain times.

This market has created tons of real estate investment opportunities. You need to know how to find and structure the deal.

As always, reach out to our chief wealth officer, Jo Dixit, and our team of Real Estate Wealth Advisors at www.BricksFolios.com for curated deals that fit your risk profile and real estate portfolio.

👋Join the Master Class

We are teaching a Master Class: Is it 2008 again or a great wealth-building opportunity?

When?

Wednesday 21st October at 5.00 PM.

Where?

Zoom webinar, so you can join from anywhere.

What you will learn?

Learn an analytics-led approach to implementing a forward-looking roadmap to finding, analyzing, and modeling your real estate investments for success.

We will provide our take on the market, pick up a live property on the market and guide you through the process of structuring an acquisition – offer price, funding strategy, rental strategy, reinvestment, or exit strategy.

This is a paid Master Class and the fee is $30.

However, for our readers, we are offering a 100% discount coupon so that you can attend this for FREE.

We have ONLY 15 coupon codes on a first come, first serve basis.

Use this link to reserve your spot.

If the discount codes run out, please click here to reserve your paid seat!