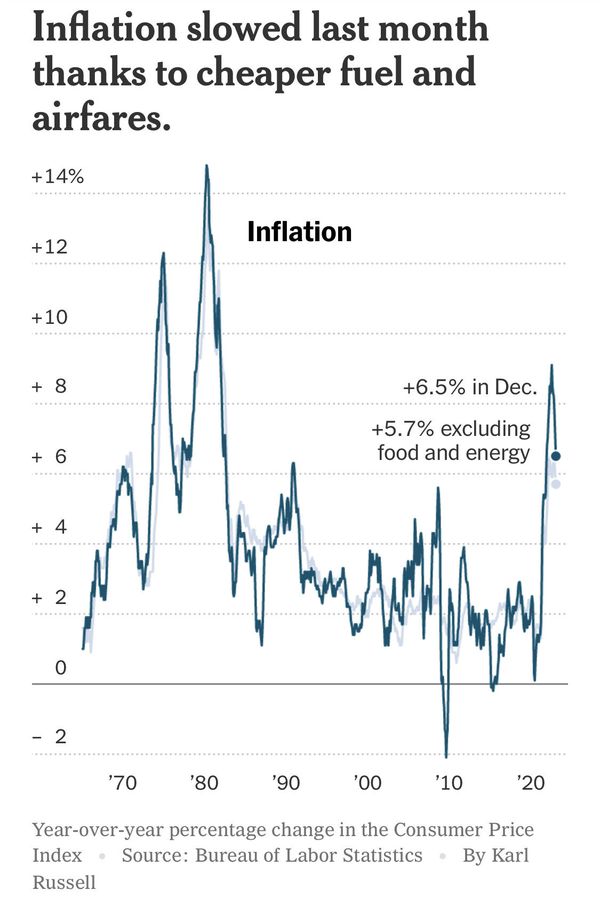

According to the December inflation report, the consumer price index (CPI) has shown a downward trend, reaching 6.45%.

This is the sixth consecutive month of deceleration after reaching a peak of 9.1% in June 2022.

This trend in inflation is closely related to mortgage rates, as inflation and interest rates have an inverse relationship. As inflation decreases, it is likely that the mortgage rates will also decrease, making it more affordable for individuals to purchase a home.

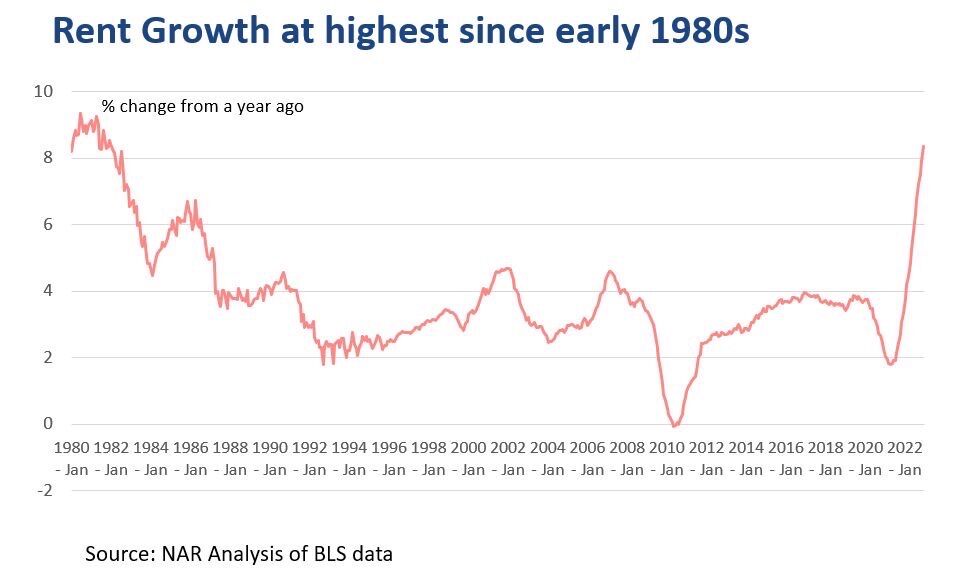

The housing market has seen persistent inflationary pressure in the form of higher mortgage rates and rising rents, however, private sector data indicates that this trend is likely to ease in the near future as an increase in apartment construction is expected to boost rental vacancy rates.

Despite the decline in overall inflation, it remains above the average hourly earnings rate of 4.6%, which has led to a decline in the standard of living for a significant portion of the population.

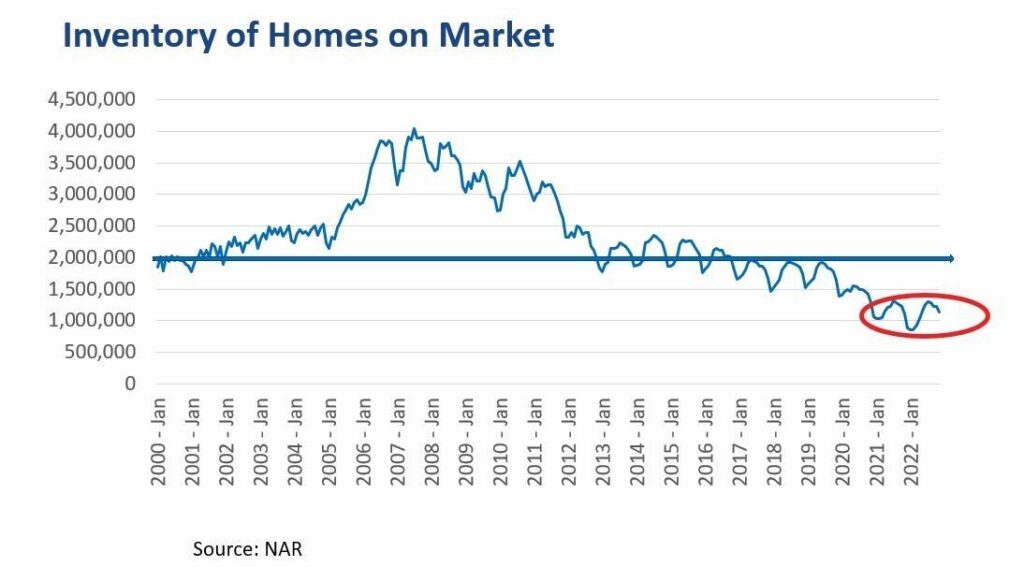

However, a persistent housing shortage and limited listings continue to pose challenges for the market.

With mortgage rates expected to decline, with a 30-year mortgage rate dropping below 6% becoming a distinct possibility, this presents a unique opportunity to secure great deals on homes and investment properties. The window of opportunity to negotiate on price and upgrades may be closing soon, so don’t miss out on this chance to grab a fantastic deal on your dream home or investment property. Not only can you negotiate hard on the purchase price and upgrades, but you’ll also have the opportunity to refinance at a lower rate in the future, potentially saving thousands in the long run.