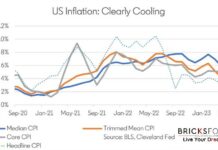

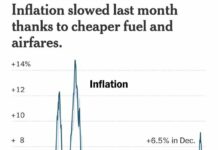

#BreakingNews Today, the Federal Reserve Board has announced a 0.25% increase in its key policy rate in its ongoing effort to curb inflation. While this rate increase was originally expected to be 0.5%, the collapse of SVB, Signature Bank, Credit Suisse and continued turmoil at smaller banks has forced the Fed to take a more cautious approach. 📉💸

The good news is that the Fed’s acknowledgment that future rate increases will depend on the significance and duration of tightened borrowing conditions indicates that it is taking a measured approach to managing inflation and promoting economic growth. The other good news is that the Fed forecast it’ll hike interest rates only one more time — probably by another 25 basis points — before pausing.💼🌱

However, it’s important to note that while the immediate reaction to the Fed’s statement has resulted in a decline in the 10-year yield as well as mortgage rates, tighter credit conditions may limit any dramatic, near-term downward movement of mortgage rates. This may make it more difficult for some homebuyers to secure funding, slowing down the housing market and potentially increasing the time it takes to sell a home. 🏡🤔

But where there are challenges, there are also opportunities!

In the medium run, economists are predicting a recession and lowering of the Fed fund rate to prop up the economy. This should help mortgage rates decline.

Waiting for the housing market to bottom?

The housing recession is over as spring comes early this year. Sales of previously owned homes spiked to about 4.58 million in February, up 14.5 percent from the previous month, according to data from the National Association of Realtors, exceeding analysts’ expectations and breaking a 12-month streak of steady declines. It’s the biggest monthly percentage increase since July 2020, although sales are still down 22.6 percent from a year ago.

If you’re able to come up with a smart funding strategy by taking advantage of the lower rate, lower prices, and lower competition, you can purchase wealth-building properties.

As the founders of BricksFolios.com, America’s Real Estate Wealth Advisor, we help our clients navigate the complexities of the housing market and understand how economic conditions may impact their real estate investments. While the current economic turmoil may create challenges, it also presents opportunities for those who are able to adapt and take advantage of changing conditions.

Reach out to us today to discuss how you can take advantage of the present economic conditions and build your real estate wealth.

#housingeconomy #realestateinvesting #opportunityknocks #wealthbuilding #smartfunding #economicconditions #housingmarketinsights #fedpolicy #BricksFolios #realestateadvisor