The US economy may be entering a recession in 2023, and if it does, it could be the wealthy who take a bigger hit than usual. This phenomenon, known as Richcession, could be caused by a variety of factors including the tumbling stock, bonds, and crypto markets, as well as tech layoffs disproportionately affecting higher-income workers.

The year 2022 has been a painful one for investors.

The S&P 500’s almost 20% drop in 2022 was devastating for investors, as it ranked as the seventh worst year in the index’s history dating back to 1929. It was a year filled with turmoil, on par with the darkest moments of the Great Depression, the 2008 financial crisis, and the dot com bust.

To make matters worse, bonds, which are typically a source of relief during difficult times in the stock market, also suffered greatly in 2022. The Bloomberg U.S. Aggregate, a benchmark for the American bond market, experienced its worst year on record with a drop of over 12% in 2022.

2022 marked the start of a new “crypto winter,” with high-profile companies collapsing across the board and prices of digital currencies crashing spectacularly. Bitcoin has sunk around 75% since reaching its all-time high in November 2021 and the entire cryptocurrency market has lost over $2 trillion in value.

The pain of the financial turmoil of 2022 will not be easily forgotten.

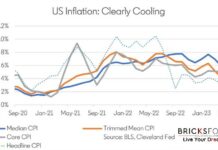

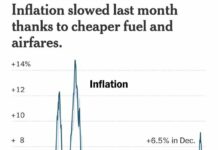

However, with sticky inflation forcing the Federal Reserve to continue to increase the Fed Fund Rates in 2023, a recession is likely and this time it is the well-off Americans who could get hurt more than usual. This phenomenon is known as Richcession.

According to Federal Reserve figures, the net worth of households in the bottom fifth of income has increased a staggering 42% since the end of 2019, while the top fifth has only seen an increase of 22%. This trend is expected to continue, with the 12-month moving average of annualized monthly wage growth for workers in the bottom quartile by income reaching 7.4% as of November 2022. On the other hand, the average annualized monthly wage growth for workers in the top quartile has been much lower at 4.8%.

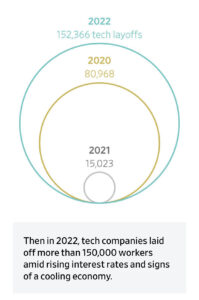

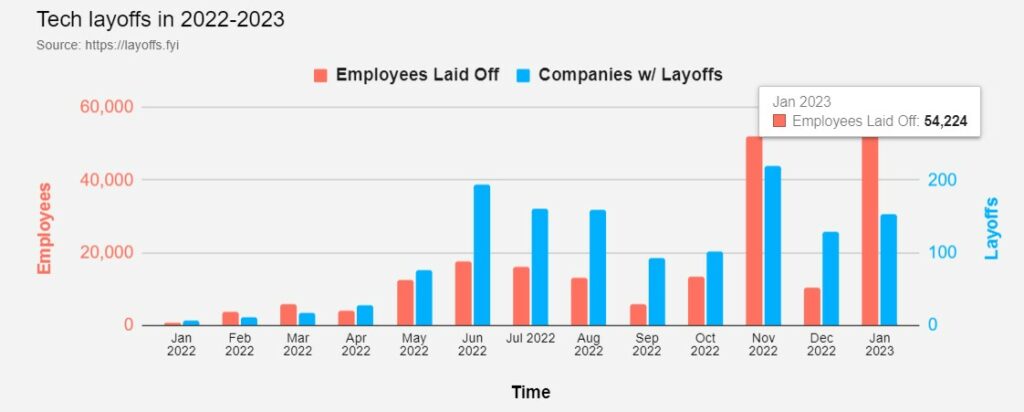

Recent layoffs have also disproportionately affected higher-income workers, with tech companies such as Facebook, Amazon, and Twitter making headlines with large-scale layoff announcements.

According to Layoffs.fyi, a website that monitors media reports and company announcements, the tech industry experienced significant job cuts in 2022, with an estimated total of over 150,000 positions being eliminated. These layoffs occurred amid a period of the economic downturn in the tech sector.

The spate of layoffs is likely to intensify in 2023. Amazon has already announced that it will cut over 18,000 jobs more than initially planned. Salesforce is cutting 10% of its workforce, more than 7,000 employees. On 18 January 2023, Microsoft announced a 5% reduction in its workforce, impacting 10,000 employees. And on 20 January 2023, Google laid off 12,000 employees, representing 6% of its workforce. These are difficult decisions that will affect many individuals and their families, and we extend our sympathy and support to those affected.

How can you weather the Richcession?

As the economy faces the potential of a recession, wealthy individuals may be forced to tighten their belts and find ways to weather the financial storm.

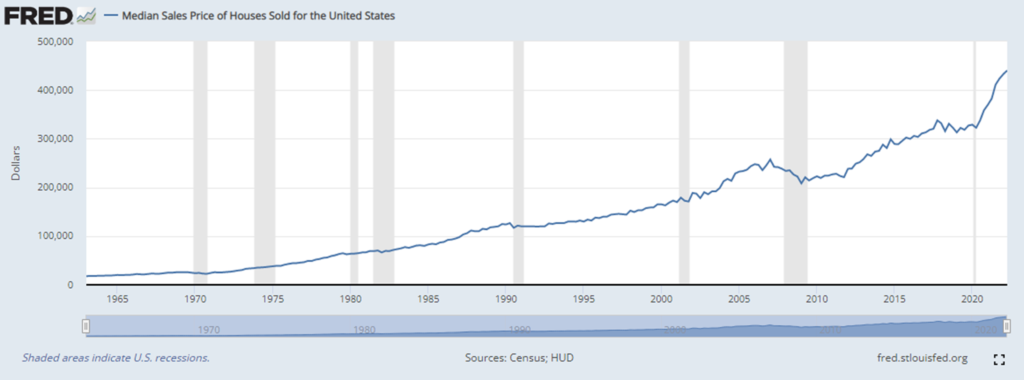

One option for them is to invest in residential real estate, which has historically been a stable and profitable investment during economic downturns. By purchasing properties at lower prices and holding onto them for the long term, wealthy individuals can generate passive income and potentially see the value of their investments increase over time.

While the average homebuyer may be deterred by the recent increase in mortgage rates, savvy real estate investors are taking a selective contrarian view, recognizing the potential benefits of lower prices, increased rental income, tax advantages, and equity growth.

They are making data-driven decisions at a property level vs. being swayed by media reports projecting gloom and doom.

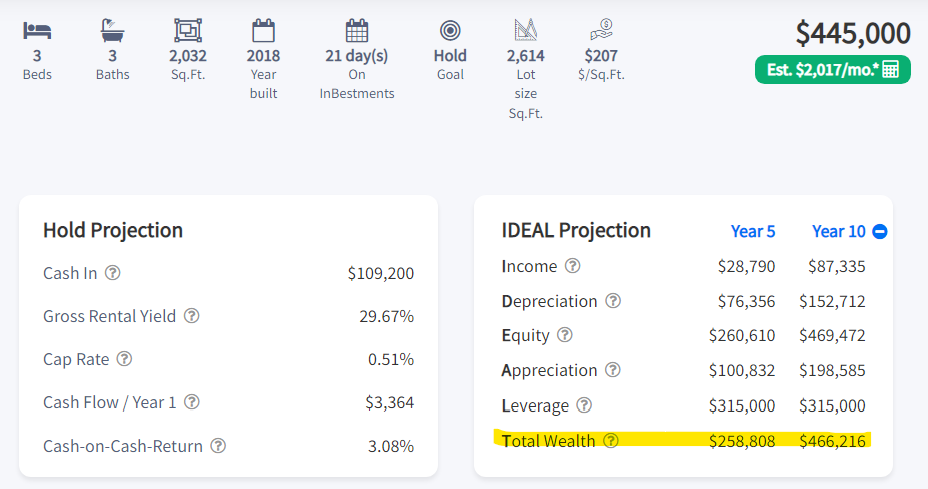

Below is an example from BricksFolios.com of how these investors analyze a property for its potential Total Wealth over the years.

By making data-driven decisions, these investors are positioning themselves for success.

This moment represents a significant opportunity, similar to the one we saw at the beginning of the pandemic or during the 2008 economic crisis.

What can we expect from the housing market in 2023?

In 2022, the real estate market experienced a dramatic shift due to the rapid increase in mortgage rates. Mortgage rates are the lifeblood that drives home sales. These rates more than doubled in a very short period of time, effectively bringing the housing frenzy to a halt.

Although the rapid increase in mortgage rates in 2022 was unprecedented, it is worth noting that the current rates are still below the average rate observed prior to the pandemic, dating back to 1971. Understanding this historical perspective is crucial in evaluating the current state of the market and identifying opportunities within it.

This year may be characterized by a sense of hangover from 2022, with a slow movement in home prices, rents, inventory, and interest rates. It may be a sluggish start. As Chief Economist at the National Association of Realtors, Lawrence Yun has noted that the mortgage market has already factored in the expected mild rate hike by the Federal Reserve. This means that if mortgage rates stabilize, we can anticipate a stabilization and potentially even an increase in home sales during the traditional buying season. As a result, home prices are expected to remain stable.

How may the Recession impact home prices?

It is important to note that an economic slowdown does not necessarily lead to a housing crisis.

In fact, during 4 of the last 6 recessions, home prices actually increased. The only two times that home prices fell were in the early 1990s and during the housing crash of 2008.

A repeat of the 2008 Housing Crash in 2023?

The early 2000s housing boom was characterized by irresponsible lending practices, in which banks granted high-risk loans to risky borrowers until the market eventually collapsed. In response to this crash, the federal government implemented regulations to better control the banking industry and promote more stringent lending practices.

At the beginning of the pandemic, with economic uncertainty looming, banks further tightened their requirements for borrowers, demanding larger down payments, excellent credit scores, and more income documentation.

As seen in the table below, this has resulted in a generation of financially secure and thoroughly vetted buyers, who are well-equipped to handle their mortgage payments, even if their home value decreases or the economy experiences challenges.

| Metric | Great Recession (Entering 2007) | COVID-19 (February 2020) |

|---|---|---|

| Home equity | 12.7B | 20.1B 29.6B (Sept 2022) 9.5B added in less than 2 years. |

| Percent of Homeowners with a Mortgage | 68.4% | 62.9% |

| Number of Active Mortgages | 53.7M | 52.9M |

| Mortgage Payment to Income Ratio | 31.8% | 20.9% |

| Percent of Homeowners w/ Less Than 10% Equity | 14.5% | 6.6% |

| Average Original Credit Score | 708 | 736 |

| Average Current Credit Score | 713 | 747 |

| Total Market CLTV | 57.4% | 52.3% |

| Average DTI at Origination | 34.5 | 33.5 |

| Mortgage Delinquency Rate | 4.92% | 3.28% |

| Number of Active Subprime Loans | 5.1M | 1.98M |

| Number of Active ARM Mortgages | 12.89M | 3.2M |

| ARM Mortgages Scheduled to Reset w/in 3 Years | 4.95M | 320K |

| GNMA/GSE Share | 63% | 75% |

Source: Black Knight & Urban Institute

Based on what we know as of now, there is minimal risk of a repeat of the housing market crash in 2008, when millions of Americans defaulted on subprime mortgages and flooded the market with excess inventory, causing home values to plummet and leading the country into a severe recession.

Supply and Demand Imbalance Persists

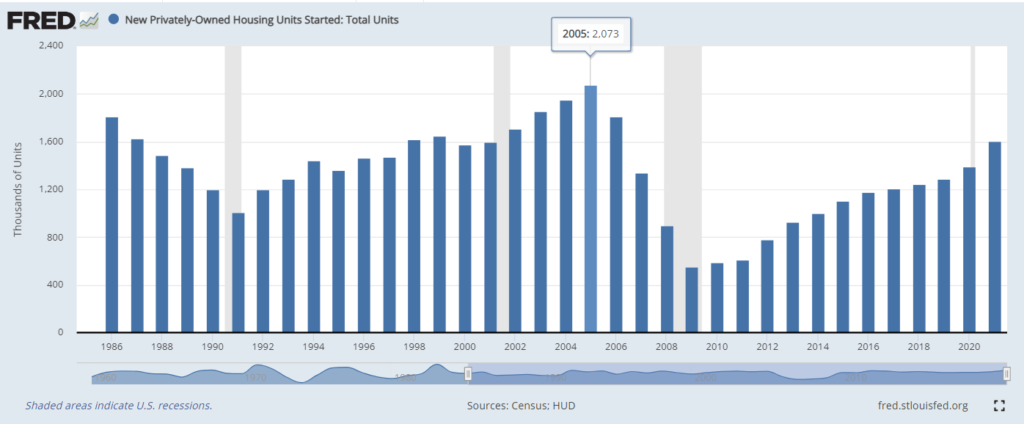

The severe imbalance between supply and demand in the housing market is a key factor driving home price appreciation. Housing completions have consistently lagged behind household growth since the Great Recession in 2008.

In the period from January 2012 to June 2021, 12.3 million U.S. households were formed, yet only 7 million new single-family homes were built. Thus, there is a housing deficit of 5.3 million.

This disparity between the number of new households and the number of new homes being built has contributed to the current shortage of housing supply and the resulting appreciation in home prices.

Work with Experts!

Real estate is a highly local market, meaning that the performance of the market can vary significantly depending on the specific location. Economic conditions, including factors such as employment rates, population growth, and income levels, can all impact the demand for housing in a particular area and, in turn, the prices of homes. For example, a region like Seattle with a strong local economy was not much impacted even during the Great Housing crisis of 2008. On the other hand, an area with a struggling local economy and high unemployment may see a decrease in demand for housing and a decrease in home prices.

When it comes to purchasing or investing in real estate, it is essential to research and understand the local market conditions. Proper analysis and scenario modeling can help ensure that you are selecting properties that have the potential to contribute to your long-term wealth.

At BricksFolios Real Estate Solutions, America’s Real Estate Wealth Advisor, we offer a trail-blazing residential real estate wealth platform and unique white-glove service to help remove the guesswork and hassle from building a smart real estate portfolio. Our Real Estate Wealth Advisors can assist you in finding wealth-building properties that align with your portfolio goals. Don’t let the process of building a successful real estate portfolio overwhelm you – let us help you acquire the right properties and achieve enduring wealth through real estate investing.