Good News.

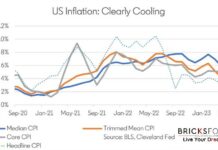

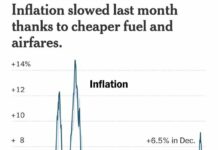

October’s Consumer Price Index (CPI) print came out this morning cooler than expected.

Meaning CPI was lower than the estimates and that might imply the hikes are taking effect.

CPI inflation continued to drop for the 4th straight month. The core number–which excludes energy and food–fell to 6.3% on the month from 6.6%.

More focuses are on the month-over-month numbers with a welcome slowdown from the core number, 0.3% on the month from 0.6%.

This a HUGE deal. Here are 3 reasons why:

#𝟭 𝗠𝘂𝗰𝗵 𝗼𝗳 𝘁𝗵𝗲 𝘄𝗼𝗿𝘀𝘁 𝗶𝗻𝗳𝗹𝗮𝘁𝗶𝗼𝗻 “𝘀𝗵𝗼𝗰𝗸” 𝗶𝘀 likely 𝗯𝗲𝗵𝗶𝗻𝗱 𝘂𝘀.

The U.S. stock market has pulled back ~20% and entered a bear market on the fears of inflation and economic growth.

The stock market is a 𝘭𝘦𝘢𝘥𝘪𝘯𝘨 indicator of the economy, and much of the selling the past year has been due to the fear of the current inflationary environment and slowing economic growth.

The Market is rallying this morning, with futures soaring over 3% in the Nasdaq.

If inflation is under control, the Federal Reserve can stop raising interest rates, and that has a HUGE impact on the market.

#𝟮 Core Inflation came in at 6.3% YOY and .3% over October

Inflation is broken into 2 parts- Headline & Core Inflation.

Headline inflation is primarily used in comparing purchasing power year over year, however, it includes food & energy prices.

Core inflation 𝘰𝘮𝘪𝘵𝘴 food and energy prices, which are highly volatile in price.

Core inflation is the preferred metric in predicting 𝘧𝘶𝘵𝘶𝘳𝘦 inflation rates.

Both numbers are not good currently – but 6.3 is a better read for where we can see inflation trending in the near-term future.

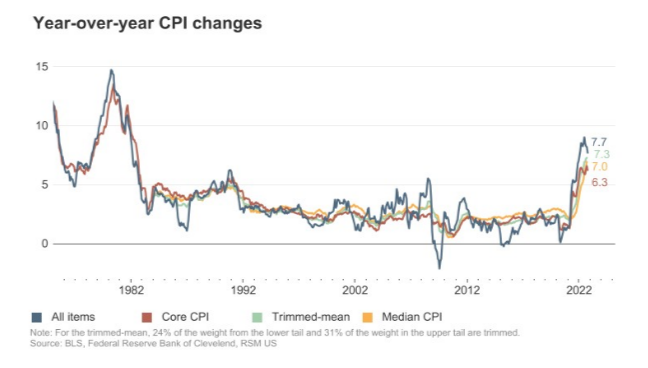

#𝟯 𝗘𝘃𝗲𝗿𝘆 𝗶𝗻𝗳𝗹𝗮𝘁𝗶𝗼𝗻𝗮𝗿𝘆 𝗽𝗲𝗿𝗶𝗼𝗱 𝗶𝗻 𝗵𝗶𝘀𝘁𝗼𝗿𝘆 𝗲𝘃𝗲𝗻𝘁𝘂𝗮𝗹𝗹𝘆 𝗲𝗻𝗱𝘀. (𝗘𝘃𝗲𝗿𝘆 𝘀𝘁𝗼𝗿𝗺 𝗿𝘂𝗻𝘀 𝗼𝘂𝘁 𝗼𝗳 𝗿𝗮𝗶𝗻)

It is very hard to predict the future.

The greatest economists, investors, and writers alike have never been able to fully pin a market bottom or price top perfectly.

The only constant in all of our historical inflationary data is that it does eventually stabilize.

It’s still too early to tell when we will see inflation back at “normal” levels.

But this too shall pass.

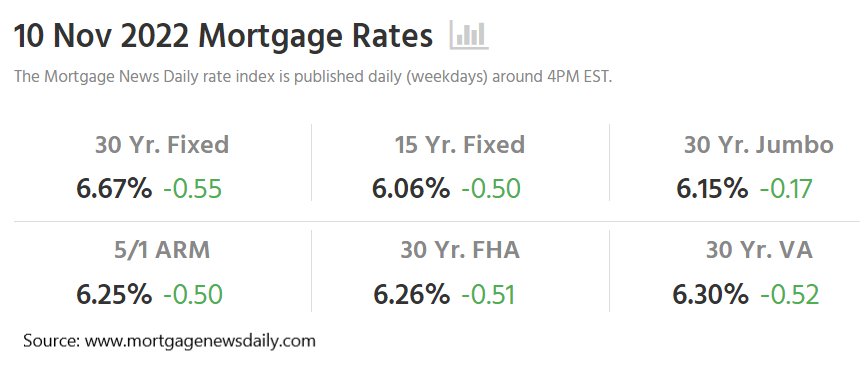

#4 How did the Mortgage Rates React to October’s CPI Report?

The Fed has been raising rates to slow inflation. Since housing is a key transmission mechanism for Fed policy, the housing market has slowed dramatically as the Fed raised rates (and mortgage rates increased).

Mortgage Rates have trended lower today driven by lower than expected increase in inflation.

#5 Will the Federal Reserve stop the Fed Rate increase?

With inflation still so high, the data reaffirm our expectations of a Fed rate hike on 14 December 2022 of at least 0.50%. Today’s report does not dispel the chances of a 0.75% Fed rate hike, but it lowers the chance somewhat.